How to File Taxes As an Affiliate Marketer: Smart Tips

To file taxes as an affiliate marketer, report your earnings on Schedule C and pay self-employment tax. Keep detailed records of income and expenses.

Affiliate marketing can be a lucrative venture, but handling taxes might seem daunting. Understanding tax obligations is crucial to avoid penalties and ensure compliance. As an affiliate marketer, you are considered self-employed, which means you must report your income and pay self-employment taxes.

It’s essential to keep thorough records of all earnings and related expenses to maximize deductions. This can help reduce your taxable income. Familiarize yourself with tax forms like Schedule C and the 1099-NEC. Seeking advice from a tax professional can also be beneficial. Proper tax management will help keep your business financially healthy.

Credit: www.instagram.com

Introduction To Taxes For Affiliate Marketers

Filing taxes is vital for affiliate marketers. This helps avoid legal troubles. Understanding tax rules ensures you comply with the law.

The Importance Of Tax Compliance

Tax compliance is crucial for your business. It keeps you safe from penalties. Accurate tax filing builds a good reputation. It also helps in financial planning.

Common Misconceptions

Many believe affiliate income is not taxable. This is false. All earnings must be reported. Some think small earnings don’t matter. This is also wrong. Every dollar counts.

| Misconception | Reality |

|---|---|

| Affiliate income is not taxable | All earnings must be reported |

| Small earnings are not important | Every dollar counts |

Identifying Your Tax Obligations

As an affiliate marketer, understanding your tax responsibilities is crucial. Knowing your obligations helps you stay compliant and avoid penalties.

Determining Your Tax Status

Your tax status as an affiliate marketer depends on your business structure. Are you a sole proprietor, an LLC, or a corporation?

- Sole Proprietor: Most affiliate marketers start here. You report business income on your personal tax return.

- LLC: This offers limited liability protection. You can choose to be taxed as a sole proprietor or a corporation.

- Corporation: You may opt for this for potential tax benefits. It requires more paperwork and compliance.

Federal And State Tax Considerations

Both federal and state taxes apply to your affiliate marketing income. Understanding these helps you stay compliant.

| Tax Type | Description |

|---|---|

| Federal Income Tax | Report your earnings on Schedule C of your 1040 form. |

| Self-Employment Tax | This covers Social Security and Medicare. Calculate using Schedule SE. |

| State Income Tax | Each state has different rules. Check your state’s requirements. |

You may also need to make estimated tax payments. These are quarterly payments for your expected tax liability. Use Form 1040-ES for federal estimated tax.

Organizing Financial Records

Organizing financial records is essential for affiliate marketers. Proper records help in filing taxes accurately and on time. It also ensures you claim all eligible deductions.

Keeping Track Of Income And Expenses

Maintain a detailed log of all income and expenses. This helps in understanding your business’s financial health. Use tools like spreadsheets or accounting software. They simplify the process and save time.

| Income Source | Amount | Date |

|---|---|---|

| Affiliate Program A | $500 | 2023-01-15 |

| Affiliate Program B | $300 | 2023-01-20 |

Best Practices For Record-keeping

- Separate personal and business finances: Use a separate bank account for affiliate income.

- Save receipts: Keep digital or physical copies of all receipts.

- Regular updates: Update your records weekly to avoid backlog.

- Use cloud storage: Store documents in the cloud for easy access and backup.

By following these best practices, you ensure smooth tax filing. Good record-keeping also helps in business growth and financial planning.

Credit: napoleoncat.com

Deducting Business Expenses

Filing taxes as an affiliate marketer involves more than reporting income. One key aspect is deducting business expenses. These deductions can significantly reduce your taxable income. Knowing what you can deduct and how to maximize these deductions is essential.

Eligible Deductions For Affiliate Marketers

Understanding eligible deductions is crucial for affiliate marketers. Here are some common deductible expenses:

- Advertising costs: Money spent on ads to promote products.

- Website expenses: Costs for domain names, hosting, and design.

- Software and tools: Expenses for SEO tools, email marketing software, and other necessary applications.

- Office supplies: Items such as paper, pens, and other office essentials.

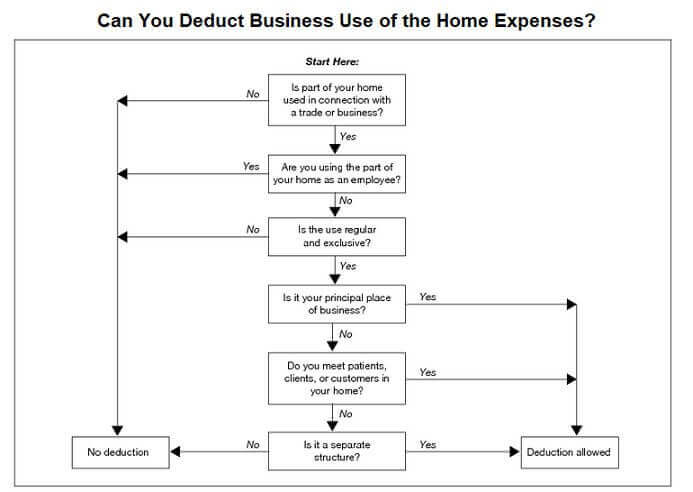

- Home office: A portion of your rent or mortgage if you work from home.

Keeping track of these expenses is vital for accurate tax reporting.

Maximizing Your Deductions

To maximize deductions, keep detailed records. Use separate accounts for business transactions. This helps in tracking every expense. Utilize accounting software to categorize expenses easily.

Here’s a table outlining some tips for maximizing deductions:

| Tip | Description |

|---|---|

| Keep Receipts | Store all receipts for business purchases. |

| Track Mileage | Record business-related travel mileage. |

| Separate Accounts | Use dedicated accounts for business expenses. |

| Hire a Professional | Consult a tax professional for guidance. |

Maximizing deductions requires diligence and organization. The effort can lead to substantial tax savings.

Choosing The Right Tax Filing Status

Filing taxes as an affiliate marketer can be confusing. Choosing the right tax filing status is crucial. It affects your tax liability and legal protections. This section will guide you through the options.

Sole Proprietorship Vs. Llc

Sole proprietorship is the simplest form of business structure. It means you and your business are the same entity. You report your income and expenses on your personal tax return. This setup is easy to manage but offers no personal liability protection.

LLC stands for Limited Liability Company. It separates your business assets from your personal assets. This protects your personal assets from business debts. An LLC can be taxed as a sole proprietorship, partnership, or corporation. It offers flexibility and protection, but it involves more paperwork and fees.

| Feature | Sole Proprietorship | LLC |

|---|---|---|

| Ease of Setup | Very Easy | Moderate |

| Liability Protection | None | High |

| Tax Flexibility | Low | High |

| Paperwork | Minimal | Moderate |

Impact On Your Tax Liability

Your tax liability varies based on your business structure. As a sole proprietor, you pay self-employment tax on your net income. You also pay federal, state, and local taxes.

An LLC offers more tax options. You can choose to be taxed as a sole proprietor, partnership, S corporation, or C corporation. This choice impacts your tax rates and deductions. Each option has its own set of rules and benefits.

- Sole Proprietorship: Simple to manage, but higher self-employment taxes.

- LLC taxed as Sole Proprietorship: Similar taxes, with added liability protection.

- LLC taxed as S Corporation: Lower self-employment taxes, more paperwork.

- LLC taxed as C Corporation: Corporate taxes, potential double taxation, more complexity.

Choosing the right tax filing status can save you money. It can also protect your personal assets. Consider your business needs and consult a tax professional if needed.

Utilizing Tax Software And Professionals

Filing taxes as an affiliate marketer can be complex. Luckily, tax software and professionals can help. These tools and experts make the process easier. They also ensure accuracy and compliance with tax laws.

Benefits Of Using Tax Software

- Ease of use: Tax software is user-friendly. It guides you step-by-step.

- Time-saving: Automated calculations save time. You don’t need to do math.

- Accuracy: Software reduces errors. It double-checks your entries.

- Cost-effective: Software is cheaper than hiring a professional. It fits small budgets.

- Access to updates: Tax software updates with new laws. You stay compliant easily.

When To Hire A Tax Professional

Sometimes, tax software isn’t enough. Here’s when to hire a tax professional:

- Complex tax situations: If you have multiple income sources or deductions, seek help.

- Facing audits: A professional can help if you’re audited. They handle the details.

- Maximizing deductions: Experts find deductions you might miss. You save more money.

- Time constraints: If you’re too busy, hire a professional. They manage everything for you.

- Peace of mind: Professionals ensure everything is correct. You avoid penalties.

Whether using software or a professional, both options simplify tax filing. Choose the best fit based on your needs.

Handling Payments And 1099 Forms

As an affiliate marketer, handling payments and managing 1099 forms is crucial. This ensures you comply with tax regulations and avoid penalties. Understanding these elements can streamline your tax filing process.

Understanding 1099 Forms

Businesses issue 1099 forms to report payments made to non-employees. As an affiliate marketer, you receive a 1099 if you earn over $600 from a company. The form details your earnings and must be reported in your tax return.

The most common form for affiliate marketers is the 1099-NEC (Non-Employee Compensation). This form reports income from freelance or contract work. Ensure you receive this form by January 31st each year.

Reporting Affiliate Income

Accurate reporting of your affiliate income is essential. First, gather all your 1099 forms. Then, log into your IRS account or use tax software to report your income. Use the figures from your 1099-NEC forms to fill out the necessary sections.

Keep records of all payments received, even those below $600. This includes payments from companies that did not issue a 1099. Documenting all income sources helps you avoid discrepancies and potential audits.

Organizing Payments

Organize your payments efficiently to simplify tax filing. Use spreadsheets or accounting software to track each payment. Include details like:

- Payment date

- Amount received

- Paying company

Regularly update your records to stay on top of your finances. This practice ensures you have all necessary information during tax season.

Example Table For Tracking Payments

| Payment Date | Amount Received | Paying Company |

|---|---|---|

| 01/15/2023 | $350 | Company A |

| 02/12/2023 | $500 | Company B |

| 03/10/2023 | $600 | Company C |

Regularly updating your payment tracker can save time and effort. It ensures accurate and timely tax filing.

Avoiding Common Tax Filing Mistakes

Filing taxes as an affiliate marketer can be tricky. Avoiding common mistakes is crucial to ensure you stay compliant and avoid penalties.

Frequent Errors And How To Avoid Them

Affiliate marketers often make several common mistakes during tax filing. Here are some frequent errors and tips to avoid them:

- Not Reporting All Income: Always report all earnings from affiliate marketing.

- Forgetting Deductions: Don’t forget to claim business expenses like hosting fees and software costs.

- Incorrectly Classifying Income: Ensure you classify your income correctly. Misclassification can lead to issues.

- Missing Deadlines: Mark your calendar for tax filing deadlines to avoid late penalties.

- Improper Record-Keeping: Keep detailed records of all transactions, including receipts and invoices.

Dealing With Audits And Penalties

An audit can be stressful. Here’s how to handle it:

- Stay Organized: Keep all financial documents well-organized and easily accessible.

- Respond Promptly: If audited, respond to the IRS promptly and provide all requested documentation.

- Seek Professional Help: Consult a tax professional if you’re unsure how to handle an audit.

- Understand Penalties: Familiarize yourself with potential penalties to avoid them in the future.

- File Accurately: Ensure all tax filings are accurate to prevent future audits.

| Common Mistake | How to Avoid |

|---|---|

| Not Reporting All Income | Report all earnings from affiliate marketing. |

| Forgetting Deductions | Claim business expenses like hosting fees. |

| Incorrectly Classifying Income | Classify your income correctly. |

| Missing Deadlines | Mark your calendar for tax deadlines. |

| Improper Record-Keeping | Keep detailed records of all transactions. |

Planning For Future Tax Seasons

As an affiliate marketer, planning ahead for future tax seasons can save you both money and stress. By being proactive, you can avoid surprises and keep your finances in check. Here are some key steps to help you plan for future tax seasons effectively.

Setting Aside Money For Taxes

It’s crucial to set aside a portion of your income for taxes. An easy way to do this is to allocate a percentage of your earnings each month. Many experts suggest setting aside 20-30% of your income for taxes. This ensures you have enough to cover your tax bill.

Consider using a separate savings account for tax money. This helps you keep your tax funds separate from your daily expenses. You can then transfer the necessary amount to this account each month. This simple step makes it easier to manage your funds.

Here’s a quick example:

| Monthly Income | Tax Percentage | Amount to Set Aside |

|---|---|---|

| $5,000 | 25% | $1,250 |

| $3,000 | 25% | $750 |

| $7,000 | 25% | $1,750 |

Strategies For Minimizing Future Tax Liabilities

There are several strategies to minimize your future tax liabilities. One effective method is to take advantage of deductions and credits. This can significantly reduce your taxable income.

Keep track of all your business-related expenses. These can include:

- Advertising costs

- Office supplies

- Software subscriptions

- Travel expenses

Make sure you keep all receipts and documentation for these expenses. This will make it easier to claim them on your taxes.

Another strategy is to contribute to a retirement plan. This not only helps secure your future but also offers tax benefits. Consider options like a SEP IRA or a Solo 401(k). These plans allow you to make significant contributions, which can be deducted from your taxable income.

Lastly, consider consulting a tax professional. They can provide personalized advice and strategies to minimize your tax burden. A tax pro can also help you stay compliant with tax laws and regulations.

By following these steps, you can plan for future tax seasons with confidence. This ensures you stay on top of your tax obligations and keep more of your hard-earned money.

Credit: livingoffcloud.com

Frequently Asked Questions

What Forms Do Affiliate Marketers Need For Taxes?

Affiliate marketers typically need Form 1099-MISC to report income. It’s important to keep detailed records of all earnings and expenses.

How Do Affiliate Marketers Report Income?

Affiliate marketers report income on Schedule C. This form is used to detail earnings and business expenses.

Are There Tax Deductions For Affiliate Marketers?

Yes, affiliate marketers can claim deductions for business expenses. Common deductions include internet costs, marketing expenses, and office supplies.

Do Affiliate Marketers Need To Pay Estimated Taxes?

Yes, affiliate marketers often need to pay quarterly estimated taxes. This helps avoid penalties for underpayment.

Conclusion

Filing taxes as an affiliate marketer can seem daunting, but it doesn’t have to be. Follow these steps to stay compliant and avoid penalties. Keep accurate records, understand your deductions, and consult a tax professional if needed. Proper tax management ensures peace of mind and financial stability for your affiliate marketing business.